The Paytm Payments Bank Limited (PPBL) has finally opened so this will be something making easy to the users, post the Paytm was launched in the month of May now it’s gone viral. For now, PPBL has launched and it has been unveiled its beta version. Paytm users can only sign up for the Paytm Payments Bank with an invitation based system.

Latest Update of Paytm App 6.0.0 For Paytm Payments Bank

In order to use the Paytm Payments Bank, people required to get the latest version of the app, V6.0.0, where the Paytm Payments Bank will be easy to get or simple to access to all users.

The entire new update will be available on both Android and iOS devices.

Not Available on Web Browser or any Physical Branch

In order to take advantage of the Paytm Payments Bank service, people have to go for using the app. It will only be available through the Paytm app for now.

People can’t sign up for Paytm Payments Bank through any other web browser. At the same time, there are no physical branches, where people can sign up either.

New Corporate Entity

Earlier than Paytm launched and unveiled the Payments Bank service, the Gurgaon based company formed and created an all-new corporate entity – Paytm Payments Bank Limited.

This new entity holds both, Paytm Wallet alongside the new Payments Bank business. Both these businesses are run by Paytm, but the Paytm Payments Bank is some kind of variation and differences from the Paytm Wallet.

The Paytm Payments Bank Signup Process

Once you update the app then you can open the same, you will then get a pop-up with Paytm Payments Bank greetings.

Read here how you can sign up for the Paytm Payments Bank process

Step 1. If you keen to proceed, tap on it. The app will appear and ask you to set a passcode for the Paytm Payments Bank, as well the app will ask you to appoint a nominee.

Step 2. Now the app will ask you enter your address (if you have shopped on Paytm before or once, you will get to see the saved addresses) or you can enter the address manually too.

Step 3. Afterward, this proceeds you need to provide your Aadhaar Number and your name which is printed on your official Aadhaar Card.

Step 4. Up next, Paytm will arrange an appearance or a visit at your site or place, to carry out all the KYC formalities, and afterward this formality will be done public can create the Paytm Payments Bank account.

Paytm Payments Bank A/C Number

The post you will be done with and complete the whole signup process, you will see and get your Paytm Payments Bank account within a few minutes with no going to any branch or doing any paperwork.

For Airtel Payments Bank, your phone number is your account number. But for Paytm Payments Bank, public required to log in through their registered ID.

Post registered public can see their bank statement as well as the wallet statement in the Paytm app.

No Minimum Balance Required

The Paytm Payments Bank account is in no need for any minimum balance, although the maximum limit is restricted to Rs. 1 lakh. Paytm Payments Bank will offer an interest at 4 percent per annum.

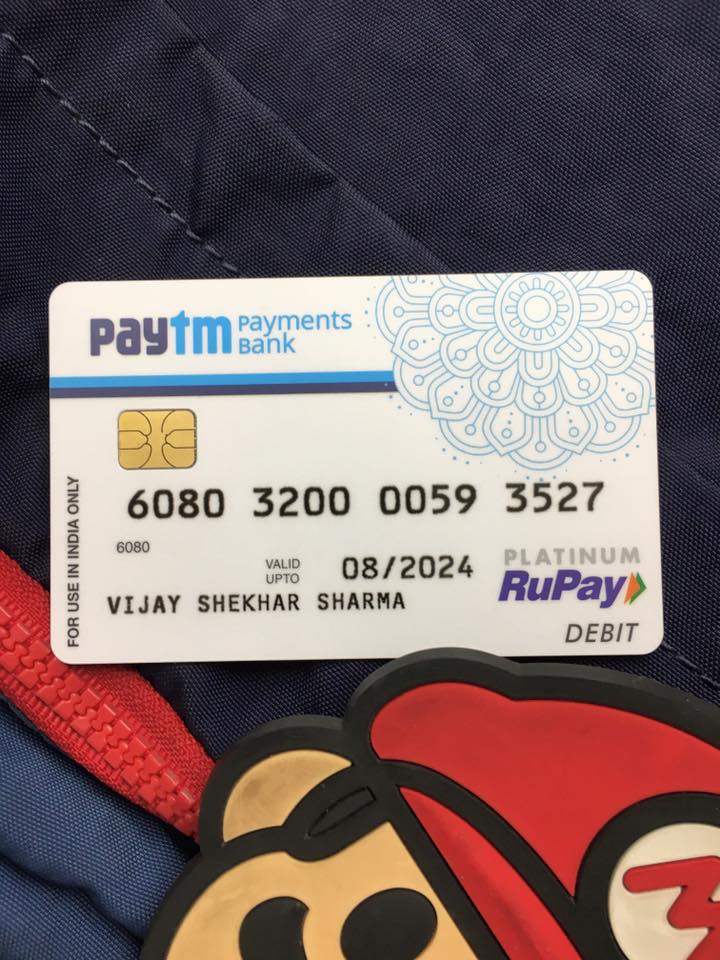

Bank Transfers And Virtual Debit Card

For all the electronic transfers (which includes UPI) from the Paytm Payments Bank account, will not carry or transmit any transaction charges. The public will also be issued a Virtual RuPay Card.

The public can use this card for online transactions, without any additional cost.

ATM Withdrawal Possible

The debit card although can be used to withdraw cash from ATMs. As of now, Paytm is not launching its own physical ATMs so far, but still public can able to withdraw cash with no additional charges.

People can withdraw cash for up to 5 times in a single month from any other bank ATM in the India. After 5 times withdrawals in a month, each withdrawal will carry a charge Rs. 20, and this will be falls under the standard specification of requirements.

Lower Interest Than Paytm Payments Bank

Airtel Payments Bank offers a higher rate of interest at 7.5 percent.

But still, it will not affect the offers of a debit card for ATM extractions or withdraws. As an alternative, the Airtel Payments Bank will give a virtual debit card.

This debit card can be used for online transactions with no additional cost.

Limitations Of Paytm Payments Bank

But there will be some limitations in using Paytm Payments Bank;

Payments Banks cannot issue a loan.

No loans means, cannot issue credit cards.

In order to offer any offer any additional services, it has to maintain alliances with other financial institutions as a support system.