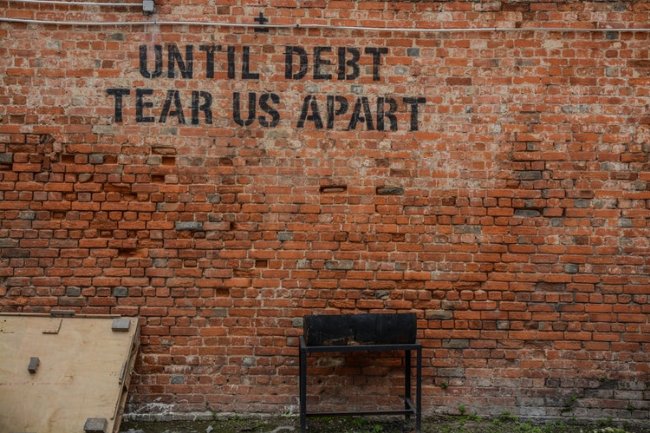

Money has never been everything. However, those who find themselves broke soon discover that being in debt is not only a financial problem but crosses into their family, career and their wellbeing.

Being in debt is not a simple thing; it breaks families, strangles careers and causes a plethora of other nasty consequences. Debt consolidation is one way you can get some relief, but there are some potential issues you should be aware of before go down that road.

Well, if you are looking forward to consolidating your debt; here are 5 potential problems with debt consolidation:

1.Longer repayment periods

With debt consolidation, some companies would want to take advantage of your desperate situation. Your monthly submissions will be less, but you will have to pay for a more extended period than you would have before the consolidation. This is an early sign that you will be remaining in debt longer than you anticipated, and you will end up paying more than your initial debts. At times, this is a risk you have to face, but it is a warning sign that you are not getting a fair deal. If you still have other options on your table, it is recommendable you pursue them.

2.Your credit score taking a hit

Paying down your debt will cause a direct hit to your credit. You will definitely recover after a year or so but it is a risk worth taking note of. Whatever form of consolidation you opt for, the lending company will have to pull out your credit report. Such inquiries will stay on for a year, and you will not be able to take another loan in the same period. Moreover, the new debt will cut down into your credit age, which will in turn, deflate your overall credit score. It does not mean that you should not go on with debt consolidation, but rather a vivid way to point out the pros and cons of what you are about to do.

3.High fees for debt relief

When you have to part with an exorbitant debt relief fee, this is a clear sign that you are not making the best decision. The harsh reality is that you will have to pay some fees, but it varies from one consolidation company to another. Take your time to review the types of fees and amount each lender is levying. Whoever is charging less should be the obvious choice. Again be on the lookout for hidden fees.

4.When you are not solving the underlying problem

If you are taking a loan to consolidate your debts and you discover that you are not addressing the problem that got you into this mess. It is okay if a medical emergency occasioned your debt. But if you are taking a loan to repay the debt out of overspending and poor budgeting, it is clear that you are only treating the symptoms and not the fundamental problem.

You are merely trading one loan for another, and if you do not change your financial tendencies; you will still struggle with paying this loan as well. If you think this sounds like you, credit counseling may be the thing that could help solve this problem.

5.Repaying more than you are comfortable with

The reason why you decided to consolidate your debt is that you cannot keep repaying them at the current rate. The consolidation plan should offer you some relief regarding the monthly payments. However, some lenders would trick you into believing that you will be paying smaller instalments only for you to realise that is not the case. The moment you notice that you will be paying more than you are comfortable with, it is a warning sign of danger ahead. So be sure to check and double check everything before you sign on the dotted line.

Bottom line

There is nothing fun about being in debt and while debt consolidation is one of the easiest ways to deal with massive debts, it comes with a number of risks. This post just gave a heads up on the dangers you should look out for. Besides, you can also get more insights from NationalDebtReliefReviews.com here you will find a lot of debt relief resources.