After you leave your job, you need all the control you can gain over your life. After all, an ideal retirement is one where you can be who you are after retiring from work. Therefore, your investments are of utmost importance for a tension-free retirement. To finance their retirement aspirations, wise investors opt for the right retirement plans.

Several investors think about investing in various assets to earn substantial profits, while others consider taking the safe route and investing in government programmes. So, where can you put your money to ensure a wonderful and happy retirement? We are here to help you decide!

WHAT IS A RETIREMENT PLAN?

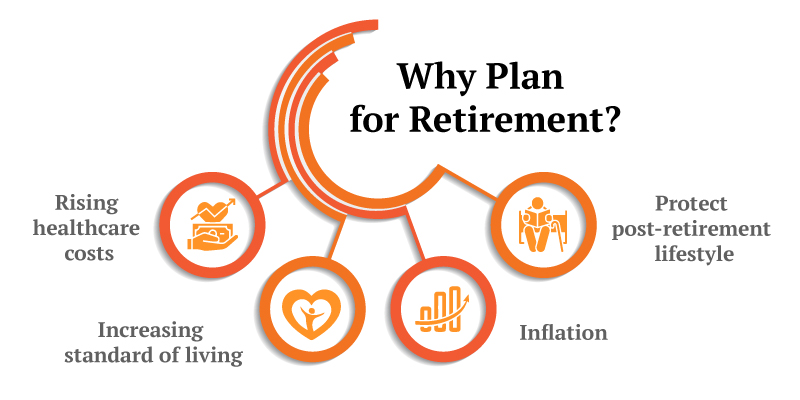

A retirement plan might be very beneficial if you’re eager to start the practice of saving money for your golden years. When done correctly, retirement planning can guarantee that you have a large corpus of funds to protect your and your dependents’s future.

Regardless of your type of retirement plan, you will need to invest regularly in it during your working years. If you outlive the plan’s duration, you will get your retirement benefits after the term, either in a lump sum payout or in the form of recurring payouts.

WHAT ARE THE TYPES OF RETIREMENT PLANS AVAILABLE IN INDIA?

If you’re ready to start with your retirement planning, there are numerous plans available in India. To begin, you can use a retirement planning calculator to determine how much money you’ll need to save before deciding on the best plan for your future. This aids in helping you create an investment budget that considers your requirements and aspirations after retirement.

Considering their different classifications and features, the retirement plans available in India can be classified into the following eight categories:

- Unit-Linked Insurance Plans (ULIPs)

ULIPs are popular insurance products that contain an element of investing in market-linked financial instruments. Some Whole Life ULIPs keep the invested money for the entire lifespan of the policyholder. After retirement, partial withdrawals from the accumulated corpus can be made by the policyholder at regular intervals and be utilized as tax-free income.

- Immediate Annuity

An annuity is defined as an agreement between the insurance company and the policyholder, wherein the policyholder pays a premium and receives a regular payout (called pension) from the insurance company after retirement. An immediate annuity starts paying out to the policyholder immediately after the policy is purchased. The policyholder pays a lump sum at the time of purchase. The payout can start as early as a month.

- Deferred Annuity

Deferred Annuity Plans require the policyholders to make regular premium payments over an investment period. The annuity benefits accumulate during this phase, and the payout starts at a later date after a predefined period has elapsed since the purchase.

- Annuity Certain

These plans pay the annuity to the policyholder for a set number of years. In case of the policyholder’s untimely demise during this period, the remaining benefits are paid out to the nominee(s).

- Guaranteed Period Annuity

This plan pays out a guaranteed annuity to the policyholder for a set period of years, even if the policyholder meets an untimely demise during this time.

- Life Annuity

The pension from a life annuity is paid to the policyholder until death. Additionally, if they have opted to include their spouse in the plan, the pension amount is paid to the spouse in the event of death of the policyholder.

- Pension Plans (With And Without Life Cover)

A pension plan with life cover has the added benefit of a sum assured payout to the policyholder’s nominees in case of the policyholder’s untimely demise. On the other hand, there is no death benefit if no life cover is included in the pension plan. However, there may be a return of premiums to the nominee.

- National Pension Scheme

Started by the government in 2004, it allows employees from the public, private, and unorganized sectors to have a recurring investment in a pension account during their employment. A portion (a small percentage) of the accumulated fund can be withdrawn at the time of retirement, and the remaining is paid out as a monthly pension post-retirement.

- Pension Funds

Pension funds, also known as retirement funds, are savings schemes for salaried employees. You are required to contribute a portion of your salary to the fund during the accumulation period to receive a monthly pension after retirement.

CONCLUSION – CHOOSE YOUR RETIREMENT PLAN WISELY

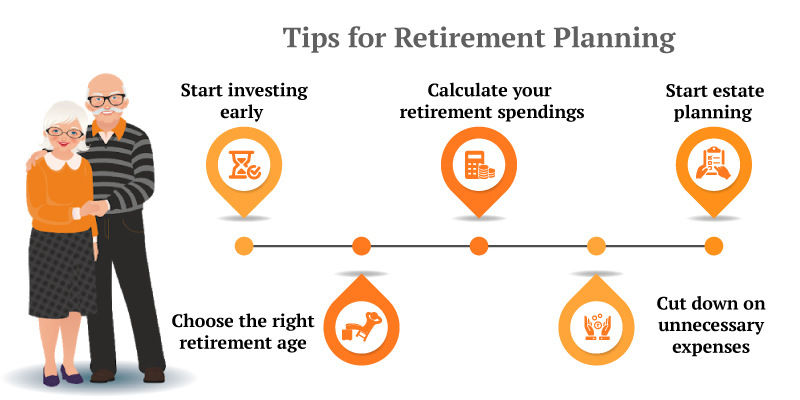

Once you understand the different retirement plans available in India, you can start evaluating and choose a suitable one for your retirement. You can either go for one of these investments or a mix of the products mentioned above, but first, you need to keep a few things in mind:

- Your retirement needs: You must first determine how much money you will need to save for retirement. You can evaluate this with the use of a retirement planning calculator. To get a more accurate estimate, don’t forget to factor in inflation as well.

- Vesting age: The age at which you begin to collect retirement benefits is known as the vesting age. If you choose the right plan, you can start to benefit from your investment as soon as your regular income stops because the vesting age will coincide with your retirement age.

- Payout Options: Retirement plan payout choices include lump sum payouts and recurring annuity payments. You must decide which payout type best meets your post-retirement objectives and choose a plan that complies with those needs.

- Premium schedules: You must pick between plans that allow for only a few premium payments and those that need you to pay premiums for the entire term of the plan, depending on your financial circumstances.

Once all this is considered, you can choose the right plan for yourself. So do not wait; maximize the benefits of the time at hand today!