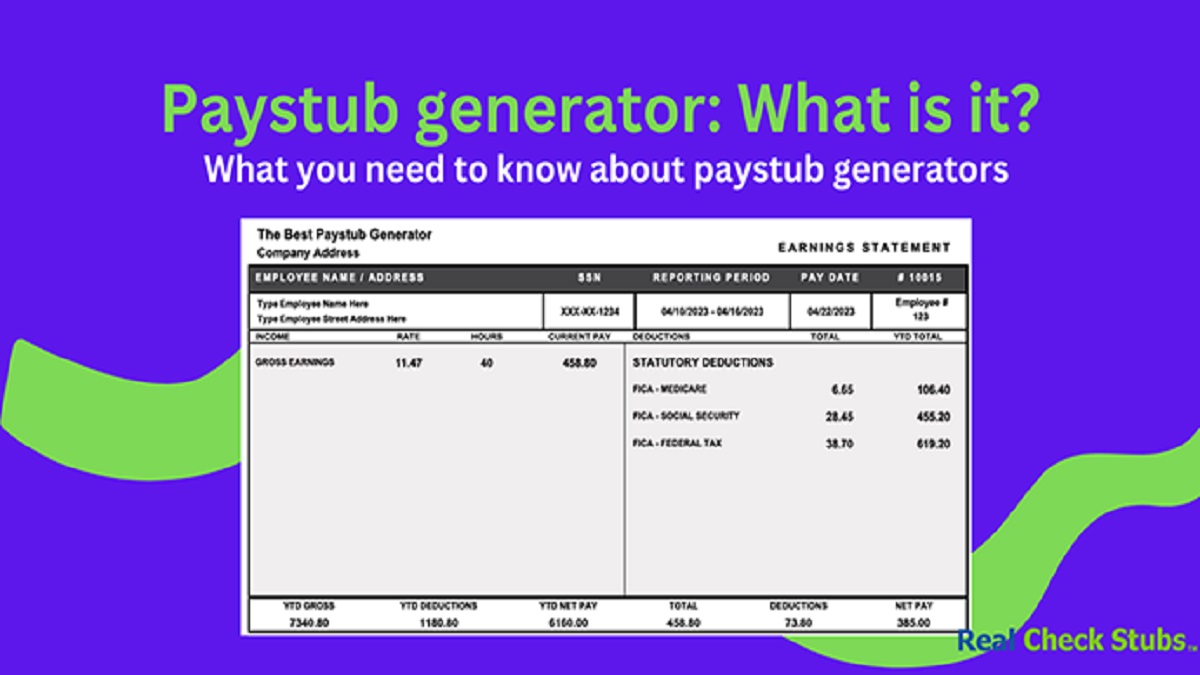

In the modern world of digital transactions and streamlined business operations, pay stubs online have become a staple for organizations of all sizes. These digital records serve as a comprehensive breakdown of an employee’s earnings, deductions, and taxes, ensuring transparency and accountability in the payroll process. Mastering the art of creating paystubs online is crucial to making the most of this digital shift. In this article, we’ll explore five essential tips to ensure that you harness the full potential of pay stub generators while maintaining accuracy, compliance, and efficiency.

Selecting the Right Pay Stub Generator

The first step in optimizing your pay stub generation process is to choose the right online tool for the job. With many options available, it’s vital to conduct thorough research. Look for pay stub generators with a user-friendly interface, customizable templates, and automatic tax calculations. These features will save you time and ensure the accuracy of your records. Consider reading user reviews and comparing the pricing structures to find the generator that best suits your business’s needs.

Inputting Accurate Information

Payroll accuracy is paramount, and the same holds true for the data you input into your pay stub generator. Ensure you enter the correct employee details, earnings, deductions, and taxes. Even a minor error can lead to confusion and discrepancies down the line. Double-check all the figures before finalizing the pay stub, as accurate data input lays the foundation for reliable records and a smooth payroll process.

Customization for Company Branding

While the primary purpose of pay stubs is to provide accurate financial information, they also present a branding opportunity. Many pay stub generators allow you to personalize the documents with your company logo, colors, and other relevant information. This not only enhances the professionalism of the pay stub but also reinforces your brand identity. However, it’s crucial to strike a balance between customization and adhering to legal standards to ensure the documents remain compliant.

Compliance with Tax Regulations

Navigating the labyrinth of tax regulations can be challenging, but a reliable pay stub generator can simplify the process. Understand the tax calculations and deductions relevant to your business’s location and industry. When using the pay stub generator, input the accurate tax information to ensure that the calculations align with legal requirements. This step is critical for both your employees’ financial well-being and your business’s legal standing.

Keeping Abreast of Legal Changes

Laws and regulations related to payroll, taxes, and employment can change over time. It’s essential to stay informed about these updates and ensure that your pay stub generator remains up-to-date with the latest tax rates and legal requirements. Review your pay stub templates and settings to ensure they align with current laws. This proactive approach helps you avoid compliance issues and maintain accurate records. Consider consulting with a legal professional to ensure your pay stubs remain compliant and accurate if there are significant legal changes.

Conclusion

As the business landscape continues to evolve, leveraging technology to streamline tasks is imperative. Pay stub generators not only simplify payroll management but also enhance the transparency and trust between employers and employees. So, take the time to choose the right generator, input data meticulously, customize thoughtfully, and stay compliant with tax regulations. By doing so, you’ll ensure that your pay stubs serve as reliable records that reflect the professionalism and integrity of your business.